#algorithmic trading software price

Explore tagged Tumblr posts

Text

Algo Trading Software Price Explained Simply

Understanding Algo Trading Software Price: A Friendly Guide

Introduction

Have you ever wondered how traders manage to buy and sell at the perfect time, even when they’re asleep? It’s not magic—it’s algorithmic trading software. But here’s the big question: How much does it cost? Whether you're new to trading or just curious, this guide breaks down everything you need to know about algo trading software price in plain English. We’ll explore how it works, what influences its cost, and how to choose the right one without burning a hole in your pocket.

Learn about algorithmic trading software price, features, and tips for picking the right automated trading software.

What is Algorithmic Trading Software?

Imagine a robot that buys and sells stocks for you while you’re out walking the dog. That’s essentially what algorithmic trading software does. It’s a tool that uses coded rules and algorithms to execute trades automatically. You set the conditions, and the software does the rest.

Why Automated Trading is a Game-Changer

Think of it like having a self-driving car—but for your investments. Instead of watching the market 24/7, automated trading software monitors it for you. It reacts to changes instantly, way faster than any human can. This means more efficiency, less emotional trading, and potentially better returns.

Factors That Influence Algo Trading Software Price

Why does one platform cost $50 a month and another $500? The price depends on things like:

Features included (like backtesting, strategy builder, indicators)

Speed and reliability

Support for multiple markets or asset classes

Customizability

Security features

Cloud vs desktop access

Just like buying a car, you get what you pay for.

Free vs Paid Trading Software: Which One Wins?

Free sounds great, right? But here’s the deal:

Free software: Great for learning or light trading. Think of it like using a bicycle.

Paid software: Comes with more tools, better support, and speed. It's more like driving a race car.

Both have their place—it depends on what you need.

Subscription-Based Pricing: Is It Worth It?

Most automated trading software follows a subscription model, often monthly or annually. Why?

Constant updates and bug fixes

Access to premium features

Customer support and new tools

If you trade regularly, subscriptions can offer good value.

One-Time Purchase vs Recurring Fees

Some platforms let you pay once and use the software forever. Others charge monthly.

One-time payments:

Pros: No recurring costs

Cons: Limited updates, might get outdated

Recurring fees:

Pros: Always up-to-date, includes support

Cons: Costs add up over time

Think of it like buying vs leasing a car.

Top Features That Affect Price

Here are some features that can significantly increase the price:

Real-time data feed

Advanced charting tools

High-frequency trading capabilities

API access for custom strategies

AI-based prediction tools

Multi-exchange connectivity

The more advanced the toolkit, the higher the price.

Entry-Level Tools: Affordable Options for Beginners

Just getting started? Don’t worry—you don’t need to spend a fortune. Some great entry-level options include:

Quanttrix

MetaTrader 4/5

QuantConnect (limited free tier)

Prices range from $0 to $50/month.

Professional-Grade Platforms and Their Costs

Quanttrix – A Rising Star in Algo Trading

Quanttrix is considered by many to be the best algo trading software in India, and for good reason. It’s built specifically for the Indian market, offering seamless integration with popular Indian brokers and exchanges like NSE and BSE. What sets it apart is its powerful automation engine combined with a user-friendly interface.

Price Range: Quanttrix offers flexible pricing plans starting around ₹2,500/month, going up based on features like real-time data feeds, multi-strategy deployment, and backtesting.

Key Features:

Plug-and-play algorithm setup

No coding required (though advanced users can integrate their own code)

Supports intraday and positional strategies

Broker APIs and real-time execution

24/7 support and regular updates

Quanttrix is especially great for traders in India who want localized support, competitive pricing, and access to Indian markets without complex setups.

Hidden Costs You Should Watch Out For

The sticker price isn’t the whole story. Watch for:

Data feed charges

Broker integration fees

Strategy storage limits

Backtesting credits

Cloud server costs

These can turn a $50/month plan into a $150/month reality.

Cost vs Value: What Really Matters

Paying more doesn’t always mean better. Focus on:

Reputation and reviews

Customer support

Ease of use

Learning resources

Community size

A tool that fits your needs is more valuable than one with flashy features you won’t use.

How to Choose the Right Software Based on Your Budget

Here’s a quick guide:

Budget

Suggested Type

$0 - $50/month

Free or basic tools like MetaTrader or Quanttrix

$50 - $150/month

Mid-tier software like Trade Ideas, NinjaTrader

$150+/month

Advanced platforms like AlgoTrader or Tradestation

Don’t go all-in if you’re just testing the waters.

Tips to Save Money Without Compromising Quality

Start with free trials

Use open-source tools like QuantConnect

Buy annual plans for discounts

Join trading communities for deals

Skip features you don’t need

You can trade smart without spending big.

Real User Stories: What People Actually Pay

Ravi from Mumbai uses a $30/month Quanttrix Pro plan and makes modest trades weekly.

Sandra in New York pays $500/month for a full AlgoTrader suite, running multiple bots.

Kumar in Bangalore uses QuantConnect’s free tier, coding his own strategies with zero cost.

Your budget and trading style determine what works for you.

Final Thoughts: Balancing Price and Performance

At the end of the day, it's not just about finding the cheapest tool—it’s about finding the right one. A good automated trading software should match your goals, skill level, and budget. Whether you're a hobbyist or aiming to go pro, there’s a tool (and a price) for everyone.

FAQs

What is the average price of algorithmic trading software? It ranges from $0 for basic platforms to over $500/month for professional tools.

Is there good free automated trading software available? Yes, platforms like QuantConnect and MetaTrader offer powerful features at no cost.

Are there any hidden costs in using algo trading software? Yes—look out for charges on data feeds, brokerage integrations, and cloud hosting.

Can I switch from a free to a paid version later? Absolutely. Many platforms offer upgrade paths as your needs grow.

How can I find the best software for my budget? Start with a trial, focus on your trading goals, and compare user reviews before buying.

0 notes

Text

DeepSeek AI Can Enhance Algo Trading and Option Trading Strategies.

DeepSeek AI - Algo Trading

DeepSeek AI is a low - cost advanced chatbot. DeepSeek AI can excel in many areas of technology and business, one of these areas is Algo Trading and Option Trading.

Read more..

#Algo Trading#DeepSeek V3#DeepSeek AI#DeepSeek R1#Algorithmic Trading#bigul#ipo price band#algo trading app#algo trading india#algo trading platform#algo trading strategies#algorithm software for trading#bigul algo#finance#free algo trading software#best algo trading app in india#AI#algorithm#algo trading software india#algorithmictradingsoftware#investment#Investment Platform#Investment Platform in India#Best share trading app in India#trading with algo#algorithmic trading software free#best algorithmic trading software#bigul algo trading#best online trading platforms#bigul algo trading review

4 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

January 18, 2025

Heather Cox Richardson

Jan 19, 2025

Shortly before midnight last night, the Federal Trade Commission (FTC) published its initial findings from a study it undertook last July when it asked eight large companies to turn over information about the data they collect about consumers, product sales, and how the surveillance the companies used affected consumer prices. The FTC focused on the middlemen hired by retailers. Those middlemen use algorithms to tweak and target prices to different markets.

The initial findings of the FTC using data from six of the eight companies show that those prices are not static. Middlemen can target prices to individuals using their location, browsing patterns, shopping history, and even the way they move a mouse over a webpage. They can also use that information to show higher-priced products first in web searches. The FTC found that the intermediaries—the middlemen—worked with at least 250 retailers.

“Initial staff findings show that retailers frequently use people’s personal information to set targeted, tailored prices for goods and services—from a person's location and demographics, down to their mouse movements on a webpage,” said FTC chair Lina Khan. “The FTC should continue to investigate surveillance pricing practices because Americans deserve to know how their private data is being used to set the prices they pay and whether firms are charging different people different prices for the same good or service.”

The FTC has asked for public comment on consumers’ experience with surveillance pricing.

FTC commissioner Andrew N. Ferguson, whom Trump has tapped to chair the commission in his incoming administration, dissented from the report.

Matt Stoller of the nonprofit American Economic Liberties Project, which is working “to address today’s crisis of concentrated economic power,” wrote that “[t]he antitrust enforcers (Lina Khan et al) went full Tony Montana on big business this week before Trump people took over.”

Stoller made a list. The FTC sued John Deere “for generating $6 billion by prohibiting farmers from being able to repair their own equipment,” released a report showing that pharmacy benefit managers had “inflated prices for specialty pharmaceuticals by more than $7 billion,” “sued corporate landlord Greystar, which owns 800,000 apartments, for misleading renters on junk fees,” and “forced health care private equity powerhouse Welsh Carson to stop monopolization of the anesthesia market.”

It sued Pepsi for conspiring to give Walmart exclusive discounts that made prices higher at smaller stores, “[l]eft a roadmap for parties who are worried about consolidation in AI by big tech by revealing a host of interlinked relationships among Google, Amazon and Microsoft and Anthropic and OpenAI,” said gig workers can’t be sued for antitrust violations when they try to organize, and forced game developer Cognosphere to pay a $20 million fine for marketing loot boxes to teens under 16 that hid the real costs and misled the teens.

The Consumer Financial Protection Bureau “sued Capital One for cheating consumers out of $2 billion by misleading consumers over savings accounts,” Stoller continued. It “forced Cash App purveyor Block…to give $120 million in refunds for fostering fraud on its platform and then refusing to offer customer support to affected consumers,” “sued Experian for refusing to give consumers a way to correct errors in credit reports,” ordered Equifax to pay $15 million to a victims’ fund for “failing to properly investigate errors on credit reports,” and ordered “Honda Finance to pay $12.8 million for reporting inaccurate information that smeared the credit reports of Honda and Acura drivers.”

The Antitrust Division of the Department of Justice sued “seven giant corporate landlords for rent-fixing, using the software and consulting firm RealPage,” Stoller went on. It “sued $600 billion private equity titan KKR for systemically misleading the government on more than a dozen acquisitions.”

“Honorary mention goes to [Secretary Pete Buttigieg] at the Department of Transportation for suing Southwest and fining Frontier for ‘chronically delayed flights,’” Stoller concluded. He added more results to the list in his newsletter BIG.

Meanwhile, last night, while the leaders in the cryptocurrency industry were at a ball in honor of President-elect Trump’s inauguration, Trump launched his own cryptocurrency. By morning he appeared to have made more than $25 billion, at least on paper. According to Eric Lipton at the New York Times, “ethics experts assailed [the business] as a blatant effort to cash in on the office he is about to occupy again.”

Adav Noti, executive director of the nonprofit Campaign Legal Center, told Lipton: “It is literally cashing in on the presidency—creating a financial instrument so people can transfer money to the president’s family in connection with his office. It is beyond unprecedented.” Cryptocurrency leaders worried that just as their industry seems on the verge of becoming mainstream, Trump’s obvious cashing-in would hurt its reputation. Venture capitalist Nick Tomaino posted: “Trump owning 80 percent and timing launch hours before inauguration is predatory and many will likely get hurt by it.”

Yesterday the European Commission, which is the executive arm of the European Union, asked X, the social media company owned by Trump-adjacent billionaire Elon Musk, to hand over internal documents about the company’s algorithms that give far-right posts and politicians more visibility than other political groups. The European Union has been investigating X since December 2023 out of concerns about how it deals with the spread of disinformation and illegal content. The European Union’s Digital Services Act regulates online platforms to prevent illegal and harmful activities, as well as the spread of disinformation.

Today in Washington, D.C., the National Mall was filled with thousands of people voicing their opposition to President-elect Trump and his policies. Online speculation has been rampant that Trump moved his inauguration indoors to avoid visual comparisons between today’s protesters and inaugural attendees. Brutally cold weather also descended on President Barack Obama’s 2009 inauguration, but a sea of attendees nonetheless filled the National Mall.

Trump has always understood the importance of visuals and has worked hard to project an image of an invincible leader. Moving the inauguration indoors takes away that image, though, and people who have spent thousands of dollars to travel to the capital to see his inauguration are now unhappy to discover they will be limited to watching his motorcade drive by them. On social media, one user posted: “MAGA doesn’t realize the symbolism of [Trump] moving the inauguration inside: The billionaires, millionaires and oligarchs will be at his side, while his loyal followers are left outside in the cold. Welcome to the next 4+ years.”

Trump is not as good at governing as he is at performance: his approach to crises is to blame Democrats for them. But he is about to take office with majorities in the House of Representatives and the Senate, putting responsibility for governance firmly into his hands.

Right off the bat, he has at least two major problems at hand.

Last night, Commissioner Tyler Harper of the Georgia Department of Agriculture suspended all “poultry exhibitions, shows, swaps, meets, and sales” until further notice after officials found Highly Pathogenic Avian Influenza, or bird flu, in a commercial flock. As birds die from the disease or are culled to prevent its spread, the cost of eggs is rising—just as Trump, who vowed to reduce grocery prices, takes office.

There have been 67 confirmed cases of the bird flu in the U.S. among humans who have caught the disease from birds. Most cases in humans are mild, but public health officials are watching the virus with concern because bird flu variants are unpredictable. On Friday, outgoing Health and Human Services secretary Xavier Becerra announced $590 million in funding to Moderna to help speed up production of a vaccine that covers the bird flu. Juliana Kim of NPR explained that this funding comes on top of $176 million that Health and Human Services awarded to Moderna last July.

The second major problem is financial. On Friday, Secretary of the Treasury Janet Yellen wrote to congressional leaders to warn them that the Treasury would hit the debt ceiling on January 21 and be forced to begin using extraordinary measures in order to pay outstanding obligations and prevent defaulting on the national debt. Those measures mean the Treasury will stop paying into certain federal retirement accounts as required by law, expecting to make up that difference later.

Yellen reminded congressional leaders: “The debt limit does not authorize new spending, but it creates a risk that the federal government might not be able to finance its existing legal obligations that Congresses and Presidents of both parties have made in the past.” She added, “I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

Both the avian flu and the limits of the debt ceiling must be managed, and managed quickly, and solutions will require expertise and political skill.

Rather than offering their solutions to these problems, the Trump team leaked that it intended to begin mass deportations on Tuesday morning in Chicago, choosing that city because it has large numbers of immigrants and because Trump’s people have been fighting with Chicago mayor Brandon Johnson, a Democrat. Michelle Hackman, Joe Barrett, and Paul Kiernan of the Wall Street Journal, who broke the story, reported that Trump’s people had prepared to amplify their efforts with the help of right-wing media.

But once the news leaked of the plan and undermined the “shock and awe” the administration wanted, Trump’s “border czar” Tom Homan said the team was reconsidering it.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Consumer Financial Protection Bureau#consumer protection#FTC#Letters From An American#heather cox richardson#shock and awe#immigration raids#debt ceiling#bird flu#protests#March on Washington

30 notes

·

View notes

Text

Crypto Exchange API Integration: Simplifying and Enhancing Trading Efficiency

The cryptocurrency trading landscape is fast-paced, requiring seamless processes and real-time data access to ensure traders stay ahead of market movements. To meet these demands, Crypto Exchange APIs (Application Programming Interfaces) have emerged as indispensable tools for developers and businesses, streamlining trading processes and improving user experience.

APIs bridge the gap between users, trading platforms, and blockchain networks, enabling efficient operations like order execution, wallet integration, and market data retrieval. This blog dives into the importance of crypto exchange API integration, its benefits, and how businesses can leverage it to create feature-rich trading platforms.

What is a Crypto Exchange API?

A Crypto Exchange API is a software interface that enables seamless communication between cryptocurrency trading platforms and external applications. It provides developers with access to various functionalities, such as real-time price tracking, trade execution, and account management, allowing them to integrate these features into their platforms.

Types of Crypto Exchange APIs:

REST APIs: Used for simple, one-time data requests (e.g., fetching market data or placing a trade).

WebSocket APIs: Provide real-time data streaming for high-frequency trading and live updates.

FIX APIs (Financial Information Exchange): Designed for institutional-grade trading with high-speed data transfers.

Key Benefits of Crypto Exchange API Integration

1. Real-Time Market Data Access

APIs provide up-to-the-second updates on cryptocurrency prices, trading volumes, and order book depth, empowering traders to make informed decisions.

Use Case:

Developers can build dashboards that display live market trends and price movements.

2. Automated Trading

APIs enable algorithmic trading by allowing users to execute buy and sell orders based on predefined conditions.

Use Case:

A trading bot can automatically place orders when specific market criteria are met, eliminating the need for manual intervention.

3. Multi-Exchange Connectivity

Crypto APIs allow platforms to connect with multiple exchanges, aggregating liquidity and providing users with the best trading options.

Use Case:

Traders can access a broader range of cryptocurrencies and trading pairs without switching between platforms.

4. Enhanced User Experience

By integrating APIs, businesses can offer features like secure wallet connections, fast transaction processing, and detailed analytics, improving the overall user experience.

Use Case:

Users can track their portfolio performance in real-time and manage assets directly through the platform.

5. Increased Scalability

API integration allows trading platforms to handle a higher volume of users and transactions efficiently, ensuring smooth operations during peak trading hours.

Use Case:

Exchanges can scale seamlessly to accommodate growth in user demand.

Essential Features of Crypto Exchange API Integration

1. Trading Functionality

APIs must support core trading actions, such as placing market and limit orders, canceling trades, and retrieving order statuses.

2. Wallet Integration

Securely connect wallets for seamless deposits, withdrawals, and balance tracking.

3. Market Data Access

Provide real-time updates on cryptocurrency prices, trading volumes, and historical data for analysis.

4. Account Management

Allow users to manage their accounts, view transaction history, and set preferences through the API.

5. Security Features

Integrate encryption, two-factor authentication (2FA), and API keys to safeguard user data and funds.

Steps to Integrate Crypto Exchange APIs

1. Define Your Requirements

Determine the functionalities you need, such as trading, wallet integration, or market data retrieval.

2. Choose the Right API Provider

Select a provider that aligns with your platform’s requirements. Popular providers include:

Binance API: Known for real-time data and extensive trading options.

Coinbase API: Ideal for wallet integration and payment processing.

Kraken API: Offers advanced trading tools for institutional users.

3. Implement API Integration

Use REST APIs for basic functionalities like fetching market data.

Implement WebSocket APIs for real-time updates and faster trading processes.

4. Test and Optimize

Conduct thorough testing to ensure the API integration performs seamlessly under different scenarios, including high traffic.

5. Launch and Monitor

Deploy the integrated platform and monitor its performance to address any issues promptly.

Challenges in Crypto Exchange API Integration

1. Security Risks

APIs are vulnerable to breaches if not properly secured. Implement robust encryption, authentication, and monitoring tools to mitigate risks.

2. Latency Issues

High latency can disrupt real-time trading. Opt for APIs with low latency to ensure a smooth user experience.

3. Regulatory Compliance

Ensure the integration adheres to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

The Role of Crypto Exchange Platform Development Services

Partnering with a professional crypto exchange platform development service ensures your platform leverages the full potential of API integration.

What Development Services Offer:

Custom API Solutions: Tailored to your platform’s specific needs.

Enhanced Security: Implementing advanced security measures like API key management and encryption.

Real-Time Capabilities: Optimizing APIs for high-speed data transfers and trading.

Regulatory Compliance: Ensuring the platform meets global legal standards.

Scalability: Building infrastructure that grows with your user base and transaction volume.

Real-World Examples of Successful API Integration

1. Binance

Features: Offers REST and WebSocket APIs for real-time market data and trading.

Impact: Enables developers to build high-performance trading bots and analytics tools.

2. Coinbase

Features: Provides secure wallet management APIs and payment processing tools.

Impact: Streamlines crypto payments and wallet integration for businesses.

3. Kraken

Features: Advanced trading APIs for institutional and professional traders.

Impact: Supports multi-currency trading with low-latency data feeds.

Conclusion

Crypto exchange API integration is a game-changer for businesses looking to streamline trading processes and enhance user experience. From enabling real-time data access to automating trades and managing wallets, APIs unlock endless possibilities for innovation in cryptocurrency trading platforms.

By partnering with expert crypto exchange platform development services, you can ensure secure, scalable, and efficient API integration tailored to your platform’s needs. In the ever-evolving world of cryptocurrency, seamless API integration is not just an advantage—it’s a necessity for staying ahead of the competition.

Are you ready to take your crypto exchange platform to the next level?

#cryptocurrencyexchange#crypto exchange platform development company#crypto exchange development company#white label crypto exchange development#cryptocurrency exchange development service#cryptoexchange

2 notes

·

View notes

Text

The Federal Trade Commission has ordered information from eight companies that the agency says offer products and services that use personal data to set prices based on a shopper’s individual characteristics. In a Tuesday announcement, the FTC said it was seeking to better understand the “opaque market” of “surveillance pricing” practices using consumer data — including credit information, location and browsing history — to charge different customers different prices for the same goods. To do this, the agency noted, third-party intermediaries claim to use advanced algorithms, artificial intelligence and other technology. “Firms that harvest Americans’ personal data can put people’s privacy at risk. Now firms could be exploiting this vast trove of personal information to charge people higher prices,” FTC Chair Lina M. Khan said in a prepared statement. Khan added that the FTC’s inquiry “will shed light on this shadowy ecosystem of pricing middlemen.” The FTC said it sent orders to Mastercard, Revionics, Bloomreach, JPMorgan Chase, Task Software, PROS, Accenture and McKinsey & Co.

2 notes

·

View notes

Text

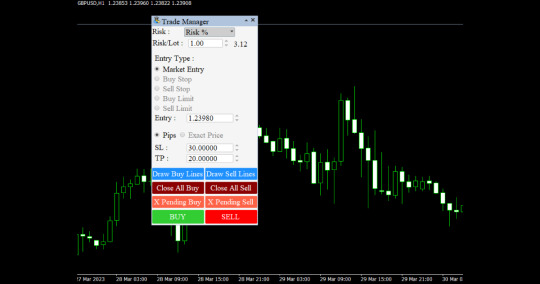

Effortless Efficiency: Automate Your Forex Trades with the Panel

In the dynamic world of forex trading, efficiency is paramount. Traders are constantly seeking ways to streamline their processes, optimize their strategies, and maximize their profits. One powerful tool that has emerged to meet these demands is the Automated Trading Panel. These panels leverage cutting-edge technology to automate trade execution, implement complex strategies, and enhance overall efficiency in forex trading. In this blog post, we'll explore the benefits, features, and potential of Automated Trading Panels in revolutionizing the way traders approach the forex market.

Understanding Automated Trading Panels: Automated Trading Panels are sophisticated software solutions designed to automate various aspects of forex trading, from trade execution to risk management and strategy implementation. These panels utilize advanced algorithms, artificial intelligence, and machine learning techniques to analyze market data, identify trading opportunities, and execute trades on behalf of traders. With their user-friendly interfaces and customizable features, Automated Trading Panels empower traders of all skill levels to automate their trading processes and achieve consistent results in the forex market.

Key Features and Functionality:

Trade Execution Automation: Automated Trading Panels enable traders to automate trade execution, eliminating the need for manual intervention. Traders can set specific parameters for trade entry, exit, and position sizing, allowing the panel to execute trades automatically based on predefined rules and criteria.

Strategy Implementation: Automated Trading Panels support the implementation of complex trading strategies, including trend-following, mean-reversion, and breakout strategies. Traders can customize their strategies by combining technical indicators, price action signals, and market sentiment analysis to suit their trading preferences and objectives.

Risk Management Tools: Automated Trading Panels offer advanced risk management tools to help traders mitigate potential losses and protect their capital. Traders can set stop-loss and take-profit levels, adjust position sizes, and implement trailing stop orders to manage risk effectively.

Backtesting and Optimization: Automated Trading Panels enable traders to backtest and optimize trading strategies using historical market data. By simulating trades under various market conditions, traders can assess the performance of their strategies and make necessary adjustments to improve profitability.

Real-time Market Analysis: Automated Trading Panels provide real-time market analysis and insights, allowing traders to stay informed about key market developments and potential trading opportunities. With access to up-to-date market data and analysis tools, traders can make informed decisions and execute trades with confidence.

Benefits of Using Automated Trading Panels:

Enhanced Efficiency: Automated Trading Panels streamline the trading process by automating repetitive tasks such as trade execution, position management, and risk assessment. By eliminating the need for manual intervention, traders can save significant time and effort. This enhanced efficiency allows traders to focus their attention on analyzing market trends, refining trading strategies, and making informed decisions, rather than getting bogged down by routine tasks.

Improved Accuracy: Automated Trading Panels leverage sophisticated algorithms and artificial intelligence to execute trades with precision and accuracy. Unlike human traders, who may be prone to emotions, biases, and cognitive errors, these panels operate based on predefined rules and criteria. By removing human involvement from the trading process, Automated Trading Panels minimize errors and enhance overall trading performance. Trades are executed consistently and objectively, without the influence of emotions such as fear, greed, or hesitation.

Consistent Performance: With their disciplined approach to trade execution and risk management, Automated Trading Panels help traders achieve consistent and reliable results over time. These panels adhere strictly to predetermined trading rules and strategies, ensuring that trades are executed in a systematic and disciplined manner. By maintaining consistency in trade execution and risk management, traders can avoid impulsive decisions and erratic behavior, thereby improving their chances of long-term success in the forex market.

Accessibility and Convenience: Automated Trading Panels are accessible from any internet-enabled device, allowing traders to monitor and manage their trades on the go. Whether at home, in the office, or on vacation, traders can stay connected to the forex market and take advantage of trading opportunities anytime, anywhere. This level of accessibility and convenience enables traders to stay informed about market developments, adjust their trading strategies, and execute trades promptly, without being tied to a specific location or time zone.

Reduced Stress and Emotional Impact: Trading can be a stressful and emotionally taxing endeavor, particularly during periods of market volatility or when faced with significant losses. Automated Trading Panels help alleviate stress and emotional strain by automating the trading process and removing the need for manual intervention. Traders can trade with confidence, knowing that their trades are being executed according to predefined rules and parameters. By removing the emotional element from trading decisions, Automated Trading Panels help traders maintain a clear and rational mindset, reducing the psychological burden associated with trading and improving overall well-being.

Automated Trading Panels offer numerous benefits to traders, including enhanced efficiency, improved accuracy, consistent performance, accessibility and convenience, and reduced stress and emotional impact. By leveraging advanced technology and automation, traders can streamline their trading processes, optimize their performance, and achieve greater success in the forex market.

Conclusion:

Automated Trading Panel offer a powerful solution for automating forex trades and enhancing trading efficiency. With their advanced features, customizable settings, and user-friendly interfaces, these panels empower traders to execute trades with precision, consistency, and confidence. Whether you're a seasoned trader looking to optimize your trading strategies or a novice trader seeking to streamline your trading process, Automated Trading Panels can help you achieve your trading goals with ease. Embrace the future of forex trading with Automated Trading Panels and experience the benefits of effortless efficiency in your trading journey.

#Trade Panel#Trading Panel#Trading Panel EA#TradePanel MT4#Trade Manager#Forex Trade Manager#Best Trade Manager#Trade Management utility#Trade Management tool#Trading management#forextrading#forexmarket#forex education#forexsignals#forex#black tumblr#technical analysis#4xPip

4 notes

·

View notes

Text

Download US30 EA

Elevate your forex trading game with the Download US30 EA, a cutting-edge Expert Advisor designed to enhance your trading experience on the MetaTrader platform. This powerful tool brings precision, adaptability, and innovation to the forefront, promising traders a dynamic solution for navigating the complexities of the financial markets.

Key Features:

Precision Trading: The US30 EA is equipped with a sophisticated algorithm that ensures precise market analysis. This empowers traders to make informed decisions based on accurate data, allowing them to navigate the ever-changing dynamics of the forex market with confidence and strategic precision.

Adaptability: Market conditions can be unpredictable, but the US30 EA excels in adaptability. Whether facing volatile price movements or evolving trends, this Expert Advisor dynamically adjusts its strategies in real-time, providing traders with the flexibility to optimize performance across various market scenarios.

Innovation: Staying ahead in the fast-paced world of forex trading is crucial. The US30 EA incorporates innovative features and strategies, ensuring traders have access to the latest advancements in trading technology. This commitment to innovation positions users strategically in the competitive landscape of forex trading.

Membership Benefits:

Join a vibrant community of traders who have harnessed the power of the US30 EA. As a member, you'll enjoy exclusive benefits, including:

Regular Updates: Stay ahead of market changes with continuous updates and enhancements to the US30 EA. Our team is dedicated to refining the software to ensure it remains at the forefront of performance.

Educational Resources: Access a wealth of educational materials designed to deepen your understanding of automated trading strategies. This empowers you to maximize the potential of the US30 EA and refine your overall trading approach.

Community Support: Connect with like-minded traders, share insights, and benefit from a supportive community committed to achieving success in forex trading.

Getting Started:

Take control of your trading journey by downloading the US30 EA today. Click the link below to access a tool that combines precision, adaptability, and innovation for unparalleled results on the MetaTrader platform

#ForexTrading#ExpertAdvisor#MetaTrader#US30EA#TradingTools#AlgorithmicTrading#TradingPrecision#InnovationInTrading#TradeSmart

2 notes

·

View notes

Text

MEV Bots vs. Traditional Crypto Trading Bots: What’s the Difference?

In the fast-evolving world of crypto trading automation, not all bots are created equal. Two distinct categories have gained significant traction—Traditional Crypto Trading Bots and MEV (Miner Extractable Value) Bots. While both operate autonomously and aim to generate profit, the way they work, the strategies they use, and even their ethical implications diverge drastically.

If you're building a trading automation system or investing in crypto bot development, understanding the key differences between MEV bot development and traditional bots is essential. Let’s dive into their fundamentals, how they function, and what makes them unique.

What Is a Traditional Crypto Trading Bot?

Traditional crypto trading bots are software programs designed to automate trading activities on centralized or decentralized exchanges based on predefined strategies. These bots remove emotion and manual work from the trading process, enabling users to execute trades 24/7 based on market signals, indicators, or specific triggers.

Common Strategies Used by Traditional Bots:

Market Making: Placing simultaneous buy and sell orders to profit from the bid-ask spread.

Arbitrage: Buying an asset at a lower price on one exchange and selling it at a higher price on another.

Trend Following: Using indicators like RSI, MACD, or moving averages to enter trades aligned with market trends.

Grid Trading: Placing buy and sell orders at fixed intervals above and below a set price to capture volatility.

These bots operate within the rules of the market and do not rely on manipulating transaction ordering or blockchain-level mechanics.

What Is an MEV Bot?

MEV bots, on the other hand, are far more advanced and operate on a deeper layer of the blockchain. MEV (Miner Extractable Value) refers to the additional profits that a block proposer or validator can extract by manipulating the order and inclusion of transactions in a block.

MEV Bots Exploit:

Front-running: Detecting a profitable transaction in the mempool and placing a similar trade with a higher gas fee to be executed first.

Back-running: Placing a trade right after a known large transaction to take advantage of price changes.

Sandwich attacks: Surrounding a user's transaction with buy and sell orders to exploit slippage.

Liquidation sniping: Monitoring lending platforms for positions nearing liquidation and front-running them to profit from the event.

These bots interact directly with the Ethereum mempool, simulate transaction outcomes, and may submit bundles through systems like Flashbots to ensure priority inclusion without getting outbid in gas wars.

Key Differences Between MEV Bots and Traditional Trading Bots

1. Target Environments

Traditional Bots: Operate on both centralized exchanges (CEXs) like Binance or Coinbase, and decentralized exchanges (DEXs) like Uniswap or PancakeSwap.

MEV Bots: Exclusively operate on decentralized networks, particularly Ethereum and other EVM-compatible chains where transaction ordering is crucial.

2. Strategy Complexity

Traditional Bots: Rely on technical indicators, API data, and predictable algorithms. The logic is rule-based and relatively straightforward.

MEV Bots: Use real-time mempool scanning, smart contract simulation, and complex on-chain logic. These bots require a deeper understanding of blockchain mechanics and transaction ordering.

3. Infrastructure Requirements

Traditional Bots: Can be hosted on regular cloud servers and utilize exchange APIs.

MEV Bots: Require low-latency access to the mempool, Flashbots relays, blockchain simulators, and custom RPC endpoints to be competitive.

4. Ethical and Regulatory Implications

Traditional Bots: Generally considered fair tools used by traders of all levels.

MEV Bots: Can be controversial. Sandwich attacks and front-running may negatively affect unsuspecting users and raise ethical questions, although some MEV strategies (like arbitrage or liquidation) are neutral or beneficial to network stability.

5. Profit Models

Traditional Bots: Profit from price movement and trade execution efficiency.

MEV Bots: Profit from transaction ordering—capitalizing on timing, miner/validator relationships, and the architecture of DeFi protocols.

Challenges in MEV Bot Development

Creating a successful MEV bot is not a trivial task. Developers face challenges like:

Race conditions: Competing with dozens of bots for the same opportunity.

Simulation accuracy: Transactions must be tested in simulators to predict the outcome and avoid loss.

Block reordering: Risk of transactions being dropped, reordered, or reverted.

Cost of failure: Failed MEV attempts can result in wasted gas and unrecoverable losses.

Regulatory uncertainty: The legality of some MEV strategies is still a gray area.

In contrast, traditional bots face challenges like API rate limits, latency, and exchange bans, but typically not the same level of technical or ethical risk.

Flashbots: Leveling the Playing Field for MEV

One of the most notable innovations in the MEV ecosystem is Flashbots, an organization that introduced a transparent and permissionless way to access MEV opportunities. By enabling bots to send bundled transactions directly to miners/validators instead of broadcasting to the public mempool, Flashbots reduces spam and gas bidding wars, while offering a structured channel for MEV extraction.

Traditional bots have no equivalent of Flashbots because they operate entirely within standard exchange environments.

The Future of Trading Bots in Crypto

As the cryptocurrency landscape matures, the role of trading bots is expected to evolve in both scale and sophistication. Traditional bots will likely see broader adoption among institutional investors and retail traders who seek consistency and automation in their trading strategies. With improvements in artificial intelligence and machine learning, these bots may become increasingly adaptive—capable of analyzing sentiment, reacting to macroeconomic news, and fine-tuning their strategies in real time. Their integration with advanced trading terminals and portfolio management tools will also make them indispensable in managing risk and optimizing returns in both bull and bear markets.

MEV bots, on the other hand, will continue to occupy a more specialized niche within the DeFi ecosystem. The future of these bots is closely tied to the evolution of blockchain infrastructure itself. As Ethereum moves further into its post-Merge era with innovations like proposer-builder separation (PBS) and encrypted mempools, the methods used by MEV bots may need to adapt significantly. These changes could either limit predatory behavior or redefine what types of MEV opportunities are viable. Additionally, new chains and layer-2 networks may open up fresh frontiers for MEV strategies, prompting bot developers to explore cross-chain implementations and interoperable extraction techniques.

Conclusion

The comparison between MEV bots and traditional crypto trading bots reveals two vastly different approaches to automated trading in the blockchain space. While both aim to generate profit through automation, the environments they operate in, the strategies they deploy, and the technical complexities they handle are worlds apart. Traditional bots offer a relatively straightforward path to automation for traders, making them ideal for those focused on consistent, rule-based strategies using available exchange data. MEV bots, in contrast, operate on a deeper, more aggressive layer of blockchain mechanics—taking advantage of transaction ordering, mempool analysis, and smart contract behavior to extract value, often in milliseconds.

Understanding the difference is more than just a technical comparison—it’s about recognizing the evolving dynamics of the crypto market itself. As blockchain infrastructure and decentralized finance continue to develop, the tools we use to interact with these systems must also adapt. Whether you’re a developer aiming to build the next powerful trading algorithm or a trader looking to leverage automation for better results, knowing where MEV bots diverge from traditional bots can guide your decisions and shape your strategies. The world of crypto bots is vast and rapidly evolving, and choosing the right path depends on your technical skills, ethical stance, and vision for the future of trading.

0 notes

Text

Unlock Wealth with ICFM’s Best Algo Trading Course for You

In today’s fast-moving financial markets, technology plays a central role in maximizing trading efficiency, speed, and profitability. One of the most revolutionary advancements in the trading world is algorithmic trading, commonly known as algo trading. It allows traders to automate strategies and execute trades at lightning speed using pre-programmed instructions. If you want to stay competitive in the evolving landscape of stock trading, mastering algo trading is no longer optional—it’s essential. This is where the algo trading course offered exclusively by ICFM INDIA comes in.

ICFM INDIA is a trusted leader in stock market education, known for blending technical expertise with practical exposure. Their algo trading course is carefully designed to equip both aspiring and experienced traders with the skills required to thrive in an algorithm-driven market. Whether you are a trader, investor, finance student, or tech enthusiast, this course opens the door to limitless possibilities in automated trading.

What Is Algo Trading and Why Is It So Important Today?

Algo trading, or algorithmic trading, involves using computer programs and software to execute trades based on a defined set of instructions. These instructions are based on timing, price, quantity, or any mathematical model. Once programmed, algorithms execute trades without human intervention—removing emotion, increasing efficiency, and improving accuracy.

This method is widely used by institutional traders, hedge funds, and now increasingly by retail traders. Algorithms can analyze massive data sets in milliseconds, respond to market changes instantly, and carry out multiple orders simultaneously—something a human trader simply cannot match.

With automation becoming the future of stock trading, learning how to design, implement, and optimize trading algorithms gives you a competitive edge. The algo trading course by ICFM INDIA helps you do exactly that—making you not just a trader, but a tech-powered market strategist.

Why Choose ICFM INDIA for an Algo Trading Course?

While various platforms offer online resources on algo trading, what makes ICFM INDIA stand out is its industry-relevant, mentor-driven, and practice-based approach. The algo trading course at ICFM INDIA is structured to provide comprehensive knowledge, from basic algorithmic principles to advanced strategy development and live testing.

Unlike generic online tutorials, ICFM’s course is led by real market professionals who understand the intricacies of both trading and technology. Students don’t just learn theories—they build and test algorithms on live data, guided by experienced mentors who provide personalized feedback.

Moreover, ICFM INDIA offers live market exposure, helping students see how algorithms perform in real trading environments. This hands-on learning gives students the confidence and clarity they need to become independent algorithmic traders.

Course Structure and Learning Methodology

The algo trading course at ICFM INDIA is thoughtfully designed for learners from both trading and technical backgrounds. The course begins with an introduction to financial markets, trading platforms, and basics of coding (if required). Students learn about algorithmic architecture, market microstructure, backtesting techniques, and how to automate strategies using software tools.

The curriculum includes modules such as:

Basics of algorithmic trading and market mechanisms

Python programming for financial modeling

Building and backtesting strategies

Using APIs to connect with brokers

Risk management in automated systems

Live deployment of algorithms in real-time trading

ICFM ensures that even students with non-technical backgrounds are given support through foundational coding lessons and practical assignments. At every stage, theoretical knowledge is followed by practical implementation—so students don’t just learn about algo trading; they actually perform it.

Hands-On Learning: Build and Deploy Your Own Trading Bot

One of the highlights of ICFM INDIA’s algo trading course is that students get the chance to develop and deploy their own trading bots. This real-world project is not only exciting but also transformational.

By the end of the course, learners are able to write scripts that can scan the market, identify trade opportunities, place orders, manage risk, and exit trades—all automatically. This gives students the confidence to enter the market with a working algorithm and optimize it based on performance.

Students are also taught how to use backtesting tools, which simulate how an algorithm would have performed in the past. This allows traders to tweak and refine strategies before going live, minimizing risk and maximizing potential.

Who Should Enroll in the Algo Trading Course at ICFM INDIA?

ICFM INDIA’s algo trading course is ideal for a diverse range of learners:

Traders and investors looking to scale their operations with automation

IT professionals wanting to enter the financial domain

Engineering or finance students preparing for a career in fintech

Quantitative analysts aiming to refine their programming and market skills

Retail traders seeking to remove emotion and trade efficiently

No prior programming knowledge is mandatory, as the course begins from the basics and gradually progresses to advanced implementations. The only prerequisites are curiosity, commitment, and a passion for learning how trading works in the modern world.

Certification and Career Opportunities After the Course

Upon completion, students receive a certification from ICFM INDIA, validating their expertise in algorithmic trading. This certification is recognized by financial institutions and can enhance your profile when applying for jobs in trading firms, brokerage houses, or fintech companies.

Moreover, many students use the skills from the course to become full-time traders, develop their own bots, or even launch algorithm-based trading services. With technology rapidly reshaping the financial sector, the demand for algorithmic traders and quantitative analysts is growing exponentially—and this course places you at the center of that demand.

Why Algo Trading is the Future of Stock Market Participation

Speed, precision, scalability—these are the cornerstones of algo trading. As financial markets become increasingly data-driven and competitive, manual trading alone is no longer sufficient. Automated systems help remove emotion, reduce human error, and allow traders to participate 24/7 in global markets.

Moreover, algo trading empowers even small retail traders to compete with institutions by giving them access to the same tools and techniques. With the right training—like the one offered by ICFM INDIA—you can turn algorithms into powerful financial allies.

The ability to automate your trading not only increases profitability but also saves time and effort, allowing you to diversify your strategies and manage your capital more efficiently.

Conclusion: Enroll in ICFM INDIA’s Algo Trading Course and Revolutionize Your Trading Journey

The stock market is no longer ruled by gut feeling and manual decisions. In this data-driven era, algorithmic trading is the key to long-term success—and ICFM INDIA is your trusted partner in this transformation. Their expertly designed algo trading course empowers you with the technical knowledge, practical skills, and mentorship needed to excel in today’s automated markets.

Whether you are an aspiring trader, a finance student, or an IT professional looking to break into fintech, this course gives you the roadmap and tools to build and execute your own trading algorithms confidently.

Read more blogs - https://www.icfmindia.com/blog/free-vs-paid-stock-market-course-in-india-which-one-is-right-for-you

Read more blogs - https://www.openpr.com/news/4061256/boost-confidence-with-this-powerful-stock-market-course

Read more blogs - https://digideskindia-intern03.systeme.io/stock-market-classes

0 notes

Text

Stock Market Timings in India – Opening & Closing Hours

What is Stock Market Timings in India?

When people first think of the stock market, they usually imagine flashing green and red tickers, men in suits shouting across a trading floor, or screens filled with complex graphs. But have you ever wondered exactly when this exciting world comes to life each day in India? Or maybe you've thought about how traders, both human and algorithmic, plan their day around these market hours.

Whether you’re a beginner, a curious observer, or someone ready to make your first trade, knowing the stock market timings in India is the foundation of smart trading. And if you're stepping into the world of modern trading, we’ll also explore how algo trading fits into this timing, and what the best software for trading in India is to help you stay ahead of the game.

Discover what time stock market open in India, algo trading in India, and the best software for trading in India for smarter investing decisions.

Introduction to Indian Stock Market Timings

The Indian stock market is like a buzzing marketplace, but with digital boards, numbers instead of vegetables, and rupees flowing through cyberspace. Just like any marketplace, it opens and closes at specific hours.

And just like you wouldn’t show up to a movie after it ends, you don’t want to miss crucial hours in the stock market—especially when timing can literally mean money.

What Time Stock Market Open in India?

This is the most Googled question for any Indian trading beginner—and for a good reason!

The stock market in India opens at 9:15 AM and closes at 3:30 PM, Monday to Friday, except on market holidays.

These timings are followed by two major stock exchanges in India:

NSE (National Stock Exchange)

BSE (Bombay Stock Exchange)

Key Hours:

Opening Time: 9:15 AM

Closing Time: 3:30 PM

Knowing this is crucial whether you're placing manual trades or relying on algo trading bots. Think of it like a cricket match—you can’t score runs if you show up after the last over.

Pre-Opening Session: What Happens Before the Bell?

Before the official market opens at 9:15 AM, there’s a pre-open session from 9:00 AM to 9:15 AM.

Here's what goes down:

9:00 AM to 9:08 AM: Orders can be placed, modified, or canceled.

9:08 AM to 9:12 AM: Orders are matched, and equilibrium price is set.

9:12 AM to 9:15 AM: Buffer period—no activity, waiting for normal market to begin.

This session is critical for volatile stocks and IPOs, as initial price discovery happens here.

Normal Market Hours Explained

This is when the real trading action happens—from 9:15 AM to 3:30 PM.

During this time:

You can buy or sell stocks.

Prices change in real-time.

Trading volume is at its peak.

This is the main battlefield for both retail and institutional investors, where algo trading in India also kicks into high gear.

Post-Closing Session: What Happens After Hours?

After 3:30 PM, the market isn't dead. It just slows down for some cool-down operations.

3:40 PM to 4:00 PM is the post-close session, where:

Trades are allowed based on the closing price.

It’s useful for mutual funds, bulk deals, or late-position balancing.

It’s like the calm after the storm—a time to reassess, not to take risky trades.

Stock Market Holidays in India

The market doesn’t open on:

Weekends (Saturday & Sunday)

National holidays like Republic Day, Diwali, Holi, Independence Day, etc.

Every year, SEBI and exchanges release a holiday list. If you're into algo trading or use trading software, set your calendars accordingly to avoid execution errors.

How Timings Affect Retail and Institutional Investors

Retail investors typically trade during normal hours, but big players like mutual funds or FIIs often prefer the opening or closing slots for bulk trades.

🧠 Fun Fact: Most market volatility happens in the first and last 30 minutes of the trading day.

So, timing your trades is not just about “when to click buy”—it’s about strategy.

Importance of Timings for Algo Trading in India

In algo trading in India, milliseconds matter. These bots operate based on market data and time-sensitive instructions.

If the market opens at 9:15 AM, algos are ready by 9:14:59—literally a heartbeat before.

They analyze price movements.

Execute trades faster than any human.

Benefit from low-latency environments set around market hours.

Hence, any delay or ignorance of timings can cause missed opportunities or losses.

Best Software for Trading in India: Top Picks

Choosing the best software for trading in India is like choosing the right engine for your car. It powers your strategy.

Here are top platforms:

Quanttrix

✅ Perfect for algorithmic traders ✅ Easy strategy builder ✅ Live market data integration (Highly recommended if you want to automate trades.)

Upstox Pro

Fast execution, sleek design, and low brokerage.

Angel One SmartAPI

Great for coders who want to build custom algo setups.

Dhan

User-friendly and powerful for both manual and automated traders.

If you’re serious about algo trading in India, software like Quanttrix makes automation accessible, even without heavy coding skills.

Intraday vs. Delivery Trading Timings

Intraday trading has to be squared off before 3:15 PM. If you forget, your broker will auto-square it, sometimes at a loss.

Delivery trading lets you hold stocks long-term. You just need to buy before 3:30 PM.

Key takeaway: Intraday = short-term → strict timing Delivery = long-term → flexible holding

Commodity Market vs. Stock Market Timings

Many think they’re the same. They're not.

Stock Market: 9:15 AM – 3:30 PM

Commodity Market (MCX):

Morning: 9:00 AM – 5:00 PM

Evening: 5:00 PM – 11:30 PM (sometimes 11:55 PM)

So if you miss one market, the other might still be open!

Why Timings Matter for Global Investors

India’s market interacts with the world. US markets open at 7 PM IST. So:

Indian markets react to global events the next morning.

Timing trades around Fed meetings or global news is vital.

Tips for New Traders to Make the Most of Market Hours

Plan before 9:15 AM (Use pre-market analysis tools)

Avoid trading in the first 15 minutes unless you're confident

Use software with real-time alerts like Quanttrix or Kite

Monitor closing trends after 3:00 PM for next-day cues

Do’s and Don’ts During Trading Hours

Do’s ✅ Monitor the market open and close ✅ Use algo systems for speed and precision ✅ Use stop-loss always

Don’ts ❌ Don’t panic trade ❌ Don’t rely on tips without research ❌ Don’t place trades during server maintenance times

Conclusion: Timing Is Everything in Trading

The Indian stock market doesn’t just follow the clock—it beats to a rhythm. Understanding this rhythm—when to trade, when to wait, when to exit—makes all the difference between profit and loss.

Whether you're just starting out or stepping into algo trading platform, respecting market timings is your first rule of success. And with powerful platforms like Quanttrix, even complex strategies become doable.

Because in trading, just like in life—timing isn’t everything; it’s the only thing.

FAQs

What time stock market open in India? The Indian stock market opens at 9:15 AM and closes at 3:30 PM, Monday to Friday.

Can I place orders before the market opens? Yes, during the pre-open session from 9:00 AM to 9:15 AM, you can place, modify, or cancel orders.

What is the best software for trading in India? Popular ones include Zerodha Kite, Upstox Pro, and Quanttrix, which is excellent for algo trading.

Is algo trading in India legal and profitable? Yes, it's legal and growing fast. Platforms like Quanttrix make it easier and more efficient.

Can I trade after 3:30 PM in India? No, regular stock market trading ends at 3:30 PM, but post-closing sessions allow some limited activity until 4:00 PM.

2 notes

·

View notes

Text

Groww IPO GMP, Open Date, Allotment Status, Listing Date, DRHP

Groww IPO open date is expected to be in the end of year 2025. This new IPO is a book-built issue of Rs 6000 crore plus (expected). This upcoming IPO is a combination of fresh issue and offer-for-sale. The company valuation at $6 billion to $8 billion.

Read more..

#Groww IPO GMP#Groww IPO#Upcoming IPO#IPO details#IPO dates#IPO Price Band#IPO Issue Size#IPO GMP#IPO Allotment Status#IPO Registrar and Lead Managers#IPO FAQs#IPO#initial public offering#IPO Alert#IPO Objectives#IPO Time Table#IPO Open Date#IPO Close Date#IPO Lot Size Details#IPO Grey Market Premium#algo trading#algo trading app#bigul#algo trading india#algo trading platform#algo trading strategies#bigul algo#free algo trading software#algorithm software for trading#finance

0 notes

Text

How Can You Automate Your Crypto Trades With Algo Bot?

Trading cryptocurrency can be fun and give good profits. But it also takes time, attention, and quick action. The crypto market is open all the time, and prices change very fast. It is hard for people to watch the market every minute.

This is why an Algo Trading Bot is very useful. It helps you trade easily, quickly, and better. Let’s see how you can use an Algo Bot to automate your crypto trading and why it is a smart idea.

What is an Algo Bot?

An Algo Bot (algorithmic trading bot) is a software tool that trades for you. This bot has a set of rules (called an algorithm) that you choose. You tell the bot when to buy and when to sell, and at what price. After you set it up, the bot trades for you — even when you are sleeping or doing other things.

Why Use an Algo Bot?

Here are some good reasons:

Fast: Bots can react in seconds and catch good deals faster than humans.

Always on: Bots work 24/7. You won’t miss any chances.

No emotions: Bots follow your rules, not feelings.

Test strategies: You can test your plan on past data before trading.

Stay consistent: Bots follow your plan every time.

How to Automate Crypto Trades with an Algo Bot

Here is a simple way to start:

1. Pick a Good Bot

First, choose a trusted bot. Some popular bots are:

3Commas

Cryptohopper

Bitsgap

Pionex

Binance, Coinbase, and Kraken are the exchanges the bot works on. Pick a bot that is easy to use and safe.

2. Create an Account

Go to the bot’s website and make an account. Many bots let you try them for free first.

3. Connect to Your Exchange

Link your exchange account (like Binance) to your bot with an API key. The bot will trade for you but cannot move your money. For safety, allow only trading, not withdrawals.

4. Choose Your Trading Plan

Now, set your plan. You can:

Use ready-made plans from the bot

Make your own plan

Copy plans from top traders

5. Set Your Trading Rules

Decide:

Which coins to trade

How much to invest per trade

Stop-loss level to avoid big loss

Take-profit level to keep gains

How many trades per day

Clear rules help the bot trade well.

6. Test Your Plan

Before going live, test your plan on old market data. This helps you see if it works well. Many bots have testing tools. Change the plan if needed.

7. Go Live and Watch

Now start your bot. It will trade on its own based on your plan. You can watch your results on the dashboard and change settings anytime

Tips for Success

Start small: Begin with little money to learn.

Keep learning: Update your plans often.

Diversify: Trade different coins, not just one.

Use risk control: Always use stop-loss and take-profit.

Stay secure: Use strong passwords and turn on 2FA (Two-Factor Authentication).

Benefits of Using an Algo Bot

More efficient: Trades fast and smart.

Less stress: No emotional trading or panic.

Consistent: Follow your plan every time.

Flexible: You can trade anytime, anywhere.

Conclusion

Using a crypto algo trading bot to trade crypto is smart and modern. Whether you are new or experienced, an Algo Bot helps you save time, avoid stress, and trade better. Start small, learn step by step, and soon you will enjoy the benefits of automated crypto trading.

0 notes

Text

Unlocking Data Science's Potential: Transforming Data into Perceptive Meaning

Data is created on a regular basis in our digitally connected environment, from social media likes to financial transactions and detection labour. However, without the ability to extract valuable insights from this enormous amount of data, it is not very useful. Data insight can help you win in that situation. Online Course in Data Science It is a multidisciplinary field that combines computer knowledge, statistics, and subject-specific expertise to evaluate data and provide useful perception. This essay will explore the definition of data knowledge, its essential components, its significance, and its global transubstantiation diligence.

Understanding Data Science: To find patterns and shape opinions, data wisdom essentially entails collecting, purifying, testing, and analysing large, complicated datasets. It combines a number of fields.

Statistics: To establish predictive models and derive conclusions.

Computer intelligence: For algorithm enforcement, robotization, and coding.

Sphere moxie: To place perceptivity in a particular field of study, such as healthcare or finance.

It is the responsibility of a data scientist to pose pertinent queries, handle massive amounts of data effectively, and produce findings that have an impact on operations and strategy.

The Significance of Data Science

1. Informed Decision Making: To improve the stoner experience, streamline procedures, and identify emerging trends, associations rely on data-driven perception.

2. Increased Effectiveness: Businesses can decrease manual labour by automating operations like spotting fraudulent transactions or managing AI-powered customer support.

3. Acclimatised Gests: Websites like Netflix and Amazon analyse user data to provide suggestions for products and verified content.

4. Improvements in Medicine: Data knowledge helps with early problem diagnosis, treatment development, and bodying medical actions.

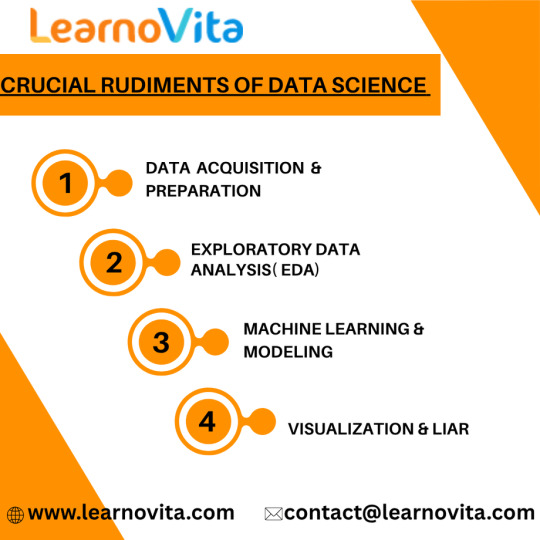

Essential Data Science Foundations:

1. Data Acquisition & Preparation: Databases, web scraping, APIs, and detectors are some sources of data. Before analysis starts, it is crucial to draw the data, correct offences, eliminate duplicates, and handle missing values.

2. Exploratory Data Analysis (EDA): EDA identifies patterns in data, describes anomalies, and comprehends the relationships between variables by using visualisation tools such as Seaborn or Matplotlib.

3. Modelling & Machine Learning: By using techniques like

Retrogression: For predicting numerical patterns.

Bracket: Used for data sorting (e.g., spam discovery).

For group segmentation (such as client profiling), clustering is used.

Data scientists create models that automate procedures and predict problems. Enrol in a reputable software training institution's Data Science course.

4. Visualisation & Liar: For stakeholders who are not technical, visual tools such as Tableau and Power BI assist in distilling complex data into understandable, captivating dashboards and reports.

Data Science Activities Across Diligence:

1. Online shopping

personalised recommendations for products.

Demand-driven real-time pricing schemes.

2. Finance & Banking

identifying deceptive conditioning.

trading that is automated and powered by predictive analytics.

3. Medical Care

tracking the spread of complaints and formulating therapeutic suggestions.

using AI to improve medical imaging.

4. Social Media

assessing public opinion and stoner sentiment.

curation of feeds and optimisation of content.

Typical Data Science Challenges:

Despite its potential, data wisdom has drawbacks.

Ethics & Sequestration: Preserving stoner data and preventing algorithmic prejudice.

Data Integrity: Inaccurate perception results from low-quality data.

Scalability: Pall computing and other high-performance structures are necessary for managing large datasets.

The Road Ahead:

As artificial intelligence advances, data wisdom will remain a crucial motorist of invention. unborn trends include :

AutoML – Making machine literacy accessible to non-specialists.

Responsible AI – icing fairness and translucency in automated systems.

Edge Computing – Bringing data recycling near to the source for real- time perceptivity.

Conclusion:

Data wisdom is reconsidering how businesses, governments, and healthcare providers make opinions by converting raw data into strategic sapience. Its impact spans innumerous sectors and continues to grow. With rising demand for professed professionals, now is an ideal time to explore this dynamic field.

0 notes

Link

#AIRegulation#algorithmicpricing#Coloradolaw#housingaffordability#PropertyManagement#realestatetech#RealPage#tenantrights

0 notes

Text

Immediate Edge Review - Reviews by Traders & Experts

Fundamentally, Immediate Edge support is a lot of than simply a service desk - it's an ally in each user's trading narrative, fostering an environment where inquiries catalyse development and challenges morph into stepping stones.

CySEC Licensed Brokers

The Cyprus Securities and Exchange Commission (CySEC), a revered EU financial oversight body, monitors forex and CFD brokers. Utilising CySEC-licensed brokers provides extra reassurance; these entities are subject to regular audits and must adhere to stringent transparency and investor protection measures.

Final Verdict: Is Immediate Edge Price it?

This automated crypto-trading system emerges as a solid answer for traders trying to capitalise on digital asset market fluctuations without constant manual intervention. Its advanced algorithms and historical information analysis capabilities enable the detection of lucrative opportunities across various exchanges and cryptocurrencies.

Boasting an intuitive platform, sturdy security protocols, and an impressive performance record, it might be a valuable resource for crypto traders at any skill level. But, a comprehensive understanding of the software and careful risk control remains essential for sustained success.

Our Methodology:

Our in depth assessment of Immediate Edge began with an intensive examination of its website, specializing in design, and easy use.

We then investigated the platform's academic materials, scrutinising content quality and verifying the qualifications of associated information providers. To measure user contentment and system reliability, we studied reviews on platforms like Trustpilot and consulted regulatory bodies regarding linked brokers.

Our technical review encompassed an analysis of Immediate Edge security protocols and their performance on totally different devices, ensuring a secure and accessible trading ecosystem.

FAQs

What Is Immediate Edge?

Through the application of mathematical algorithms, Immediate Edge could be a fully automated trading bot that actively tracks the crypto market, providing steering to each novice and professional traders to optimise their crypto trading participation.

Who owns Immediate Edge?

Formulated by accomplished traders and mathematical authorities, Immediate Edge exemplifies their ability. The precise possession of this trading bot may be unsure, however its exhaustive online evaluations validate its authenticity.

Is Immediate Edge a scam?

Let there be no misconception - Immediate Edge is entirely credible, not a scam. Our thorough testing, supported by our well-established and trusted methodology, confirms this reality. This technique entails assessing deposit and withdrawal practices, registration and KYC protocols, also as the efficacy of customer support.

Is Immediate Edge fake?

No it's not fake - Immediate Edge is real, not a sham trading tool. We've subjected the bot to thorough testing using our tried-and-true method. Our testing method involves engaging with deposit and withdrawal operations, completing registration and KYC validations, and gauging the quality of customer support.

Is Immediate Edge legit?

Yes, Immediate Edge could be a valid crypto trading resource. Our rigorous testing process has meticulously examined all components of Immediate Edge, as well as the registration method, payment methods, options, and safety and security measures, confirming its authenticity as a trading tool.

#immediateedge#immediateedgereviews#immediateedgereview#immediateedge2025#immediateedgeprice#immediateedgescam

0 notes

Text

Trading Hyperfine spiked on caching algorithms 'ai,' said B. Riley

Analyst B. Riley Yuan Zhi repeats a purchase score on Hyperfine (Hyper) with $ 1 a price target After the company's premium Swoop received weeks FDA 510k faster than expected. The next -generation MRI system includes a new scanner and OPTI artificial intelligence Software, producing the highest level of image quality and uniformity, the analyst tells investors in a research note. The company says…

0 notes